Plastic restriction policies around the world drive the promotion of environmentally friendly packaging, and plastic replacement for tableware takes the lead.

(1) Domestically: According to the “Opinions on Further Strengthening the Control of Plastic Pollution”, domestic restrictions on the use of non-degradable disposable tableware, plastic bags, etc. will be promoted step by step. The impact of the epidemic will subside in 2023. We believe that the supervision and enforcement of the plastic restriction order is expected to be strengthened and consolidated to ensure the realization of the plastic restriction target in 2025.

(2)Overseas: Plastic restriction policies in various countries have been implemented one after another. The European Union and Canada are more aggressive in restricting plastics. Developed countries such as the United States and Australia are gradually promoting plastic restrictions.

(3)Enterprise level: Driven by the concept of ESG, large enterprises around the world have taken actions to deal with plastic pollution, including promoting the application of environmentally friendly packaging. Domestic food delivery platform companies such as Meituan and Ele.me are also committed to the promotion of plastic tableware. The penetration rate of plastic tableware is still limited, and the industry scale is growing rapidly. (1) Export scale: In 2022, the export scale of plastic tableware and kitchen utensils will be nearly 2 million tons (the estimated quantity of degradable plastic products is extremely low), which is 2.32 times that of pulp molding + paper tableware, and the replacement space is still large.

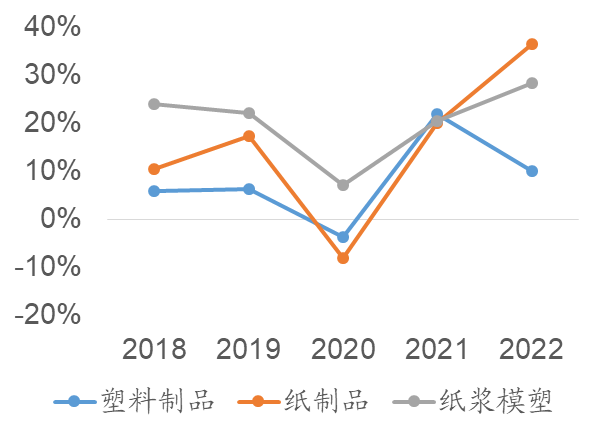

Industry growth rate: The three-year compound growth rate of pulp molding and paper tableware exports (+18%, +15%) is higher than that of plastic tableware (+9%), and the domestic and foreign sales markets are growing rapidly (three-year compound growth rate +22%) %) drives the increase in the consumption of takeaway lunch boxes, and the growth rate of plastic tableware is expected to be higher after the plastic restriction order; the related business growth of leading enterprises in the industry is even more significant.

Domestic market: In 2020, plastic materials will account for 80% of domestic takeaway lunch boxes. We estimate that in 2022, the domestic consumption of plastic takeaway lunch boxes will exceed 1 million tons, and pulp molding + paper lunch boxes will total about 200,000 tons.

Based on performance + cost + degradation conditions, we are optimistic about the development of pulp molding and the application of domestic degradable plastics. We believe that the factors influencing the selection of environmentally friendly packaging materials mainly include performance, cost, and degradation conditions. Under the premise of meeting the requirements of the degradation condition policy, when the material performance meets the packaging requirements, materials with lower cost are usually selected.

(1) Degradation conditions: The main part of pulp molding and paper products can be degraded naturally, and degradable plastics (including the coated part of paper products) need to be degraded by industrial composting, and there are policy restrictions in some markets;

(2)Performance: After modification and blending, the performance of degradable plastics can be close to that of traditional plastics; pulp molding is suitable for making products with good strength and three-dimensional shape; the shape and strength of paper products are relatively limited.

(3)Cost: The price of paper products and pulp molding is low, and the cost of plastic replacement is low. The cost of degradable plastic products is high, and the market acceptance is limited. On the whole, we are relatively more optimistic about pulp molding. Its degradation conditions are relaxed, its performance is suitable for the field of tableware with fast plastic replacement, and its cost is easy to accept.

Pulp molding: The distribution of raw materials is of great significance, and the profit margins vary greatly. Excellent enterprises will stand out. The main raw materials for pulp molding are bagasse pulp and bamboo pulp, and the upstream sources are sugarcane planting, sugar refining, and bamboo planting industries. Sugarcane and bamboo pulp resources have strong geographical attributes, and the southwest region of China is a concentrated production area; the output of bagasse pulp is limited by the sugar production of upstream sugarcane, and most bamboo pulp is used for paper making. Supply constraints make the strategic layout of enterprises in the upstream link of great significance. The current industry concentration of pulp molded tableware is low, and due to the uneven level of automation, scale effect, and operation level among enterprises, the profitability varies greatly. We believe that with the expansion of leading enterprises and the entry of other packaging companies, the industry will usher in a reshuffle, and small and medium-sized enterprises will face elimination.

Key companies: Far East & GeoTegrity: The largest pulp molded tableware manufacturer in China, focusing on pulp molded products and pulp molded equipment.

Far East & GeoTegrity is the most famous OEM manufacturer of sustainable high quality disposable pulp molded food service and food packaging products.

Our factories are certified by ISO, BRC, NSF, Sedex and BSCI, and our products comply with BPI, compostable, LFGB and EU standards. Our product range includes: Pulp molded plates, Pulp molded bowls, Pulp molded lunch boxes, Pulp molded trays, Pulp molded coffee cups, Pulp molded cup lids and Pulp molded cutlery. With state-of-the-art in-house design, prototyping and tooling production capabilities, we are also committed to innovation, offering custom services including various printing, barrier and structural technologies to enhance product performance. We have also developed PFAS solutions that are BPI compliant and compostable.

Post time: Aug-29-2023